How a 50-Year Multifamily Firm Generated New Conversations With National Developers – In 4 Months

Renown US multifamily architecture firm doubles down on 50-year reputation as growth partner

MEEKS + Partners is a 50-person, second-generation architecture firm with a 50-year history specializing in multifamily residential projects across the Sun Belt and Midwest. Led by partners Trevor, Ryan, and Keith, the firm positions itself as strategic financial partners who understand that great architecture must make the deal pencil—emphasizing density optimization, constructability, and pro forma performance over architectural aesthetics alone.

- High-rise multifamily

- Student housing and senior living

- Mixed-use developments

- Merchant builder and institutional projects

- BTR programs (100–400+ units)

Lacking networking & BD framework to leverage existing strengths

MEEKS + Partners are known for exceptional delivery and satisfaction with designs that help deals pencil in.

However, their growth was capped by a reactive, word-of-mouth business development model.

The partners were buried in day-to-day production with limited bandwidth for proactive networking and business development. Previous marketing attempts—”mind-numbing flyers” and design awards—didn’t translate into business conversations.

Even with five decades of experience, they weren’t on the radar of national developers they wanted relationships with. The 2025-2026 market slowdown made it clear: waiting for the phone to ring wasn’t a strategy.

Analyzing market opportunities and strategic positioning

The initial ramp-up period focused on analyzing MEEKS’ operations, products, and project portfolio to establish a foundation for market repositioning. The positioning shifted from design-focused to developer economics—emphasizing density optimization, constructability, and ROI. This wasn’t about chasing jobs; it was about building a system where relationships come first and projects follow.

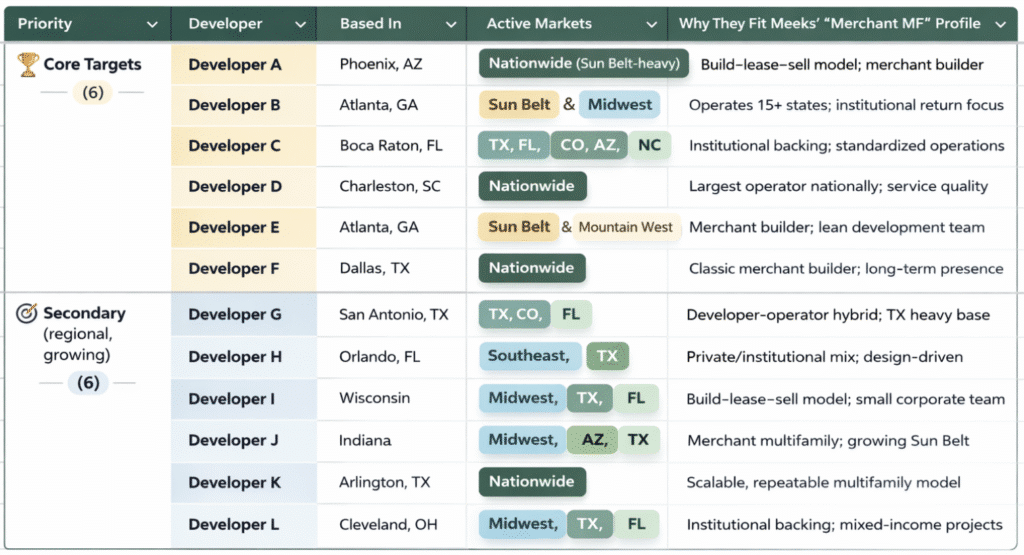

Mapping network expansion and relationship building

The strategy identified which national developers were most likely to generate opportunities. From this target list, individuals in key roles were extracted and approached through controlled, strategic outreach. One track reactivated dormant relationships with large institutional developers. Another engaged decision-makers at active firms, introducing the developer-economics approach to companies seeking stronger product prototyping partners.

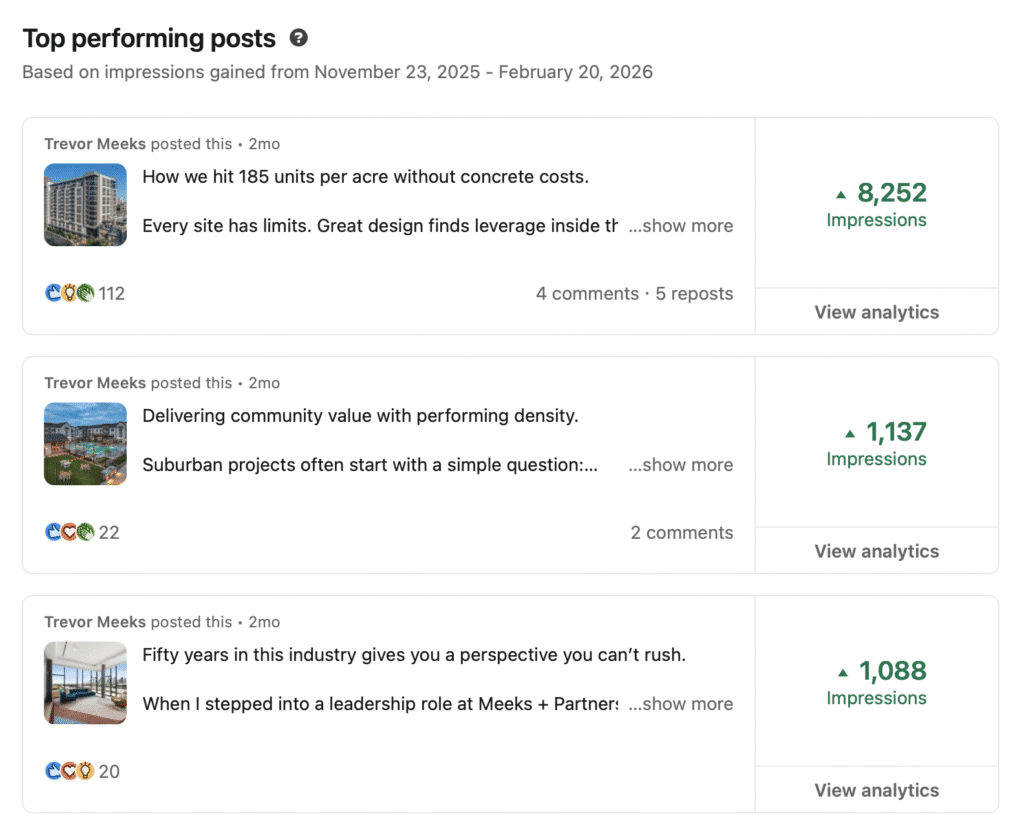

Weekly developer-centric LinkedIn content

Partner interviews became the foundation for content relevant to VPs of Development, Managing Directors, CEOs, and Financial Analysts. The content schedule addressed core topics developers face daily: underwriting gaps, ineffective product prototyping, optimal density strategies, and project economics. Each post positioned the partners as strategic advisors supporting developer growth—not designers hired for one-off projects.

Developed strategic authority assets

High-value assets were created to attract and inform connections: developer-centric case studies, a Density Chart detailing units-per-acre across product types, and a “How We Operate” document. These resources established authority before the first conversation—a quiet competence approach built on the principle that those who educate hold the authority.

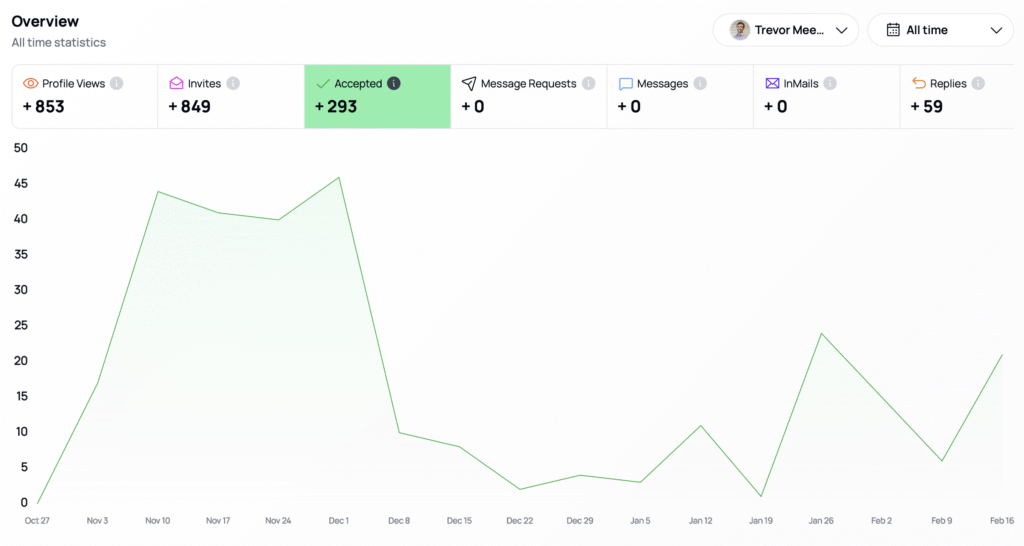

Initiated strategic content and network development

A connected strategy combined organic content with targeted network development campaigns. +110 precision connection requests went to high-priority developers, while scheduled posts built visibility. The 37.3% acceptance rate confirmed the targeting was disciplined and strategic—well above industry benchmarks for cold LinkedIn outreach.

Established high-value business conversations

Accepted connections became active conversations. The 48-hour density study suggested by the partners provided immediate value during site acquisition—proving projects “pencil” before RFPs. 28 executive conversations and 9 intro calls resulted. One contact noted: “It’s all your stuff getting put up everywhere… Who are you guys?” Relationships built on proof, not pitch decks.

From reactive to recognized: Building a BD system that works

In 4 months, with the ramp-up period we started establishing market authority, strategic positioning, and executive-level access to national developers.

Key Performance Metrics:

- 28 executive conversations initiated with key decision-makers

- 9 qualified calls booked with senior development leads at national firms

- 22,000+ quarterly content impressions across LinkedIn

- 227% audience growth (243 to 796 quality industry connections)

- Positioned as reference firm for high-density multifamily solutions

- Setting foundations for premium pricing (targeting 80th percentile)

The system sets the foundations to not just transform metrics, but market perception. Strategic assets like case studies became resources that spark conversations with key developers. The firm is moving from reactive to recognized—building relationships on proof, not pitch decks.

Next steps...

The initial four-month ramp-up period established the foundation—target identification, messaging refinement, controlled network growth, and first conversations with top-tier national developers. The next phase focuses on doubling down: deepening relationships within existing accounts by engaging regional offices across multiple states, while systematically adding new institutional developers that match the refined target profile. The approach remains measured and relationship-first—expanding deal flow through strategic positioning, not volume plays.

Book an intro call

We’ll determine if there’s a fit to work together.

Just use the calendar embed above to book your time. If it is not showing up turn off your ad blocker.

If you have any problem contact me at estefano@uncommonarchitects.com